Aug 02

Strategies that save time and money to your business

August 02, 2022

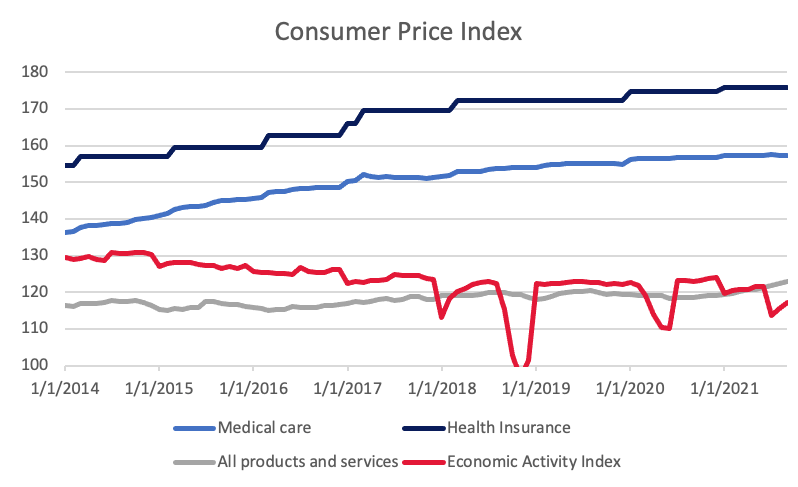

In recent times the unsustainable growth rate of health care costs consumes greater portions of the bank accounts of families, corporations and government. Spending on health care services is growing faster than the gross domestic product, and businesses are struggling to provide benefits to employees. In this economy, employers must apply new strategies to manage and administer benefits to employees in a simple, efficient way that is financially sustainable over the long term.

In recent times the unsustainable growth rate of health care costs consumes greater portions of the bank accounts of families, corporations and government. Spending on health care services is growing faster than the gross domestic product, and businesses are struggling to provide benefits to employees. In this economy, employers must apply new strategies to manage and administer benefits to employees in a simple, efficient way that is financially sustainable over the long term.

*Source: Government Development Bank; Statistics Institute of PR

Strategies

Instead of giving up on providing the basic and essential health care, human resources’ professionals are forced to do more with less, which requires technological and operational support for their processes:

Technology:

1. Use the “EXCHANGE” health platform – The most efficient and simple way for employers to provide more benefits to their employees. The employer provides a fixed contribution and various alternatives of companies and products. The employee chooses the product that best meets his or her needs and budget.

2. Transfer the role of SERVICES benefits – Use a specialized service team with an electronic platform and a call center to process all the daily requests and inquiries and claims of employees. This sets free the employer from this costly responsibility and gives employees 24/7 access to health plan management services.

Operations:

3. Transfer the role of ADMINISTRATION benefits – Delegate to an Administrator the job of processing and documenting for COBRA, FMLA, SINOT, , ERISA, HIPAA, SARs, SPD, SMM, Endorsements and 5500’s.

4. Transfer the role of MANAGEMENT benefits – Implement a comprehensive and integrated system in which a Benefits Specialist is responsible for all the steps in the benefits’ management process.

5. Develop and implement a WELL BEING AND PREVENTION program – Help reduce the severity and frequency of claims.

6. Analyze the INSURANCE program – Develop a detailed study of how the plan is used and how the health care market behaves to develop a more cost-effective insurance program.

7. Promote FINANCIAL HEALTH for employees – Offer financial planning advice and education in company facilities to benefit all employees.

Popular Risk Services, has a wide range of services and products to help our clients keep their businesses financially stable and healthy. All of the services mentioned above are part of our employee benefits administration and management offerings. Learn more.

For more information on how Popular Risk Services can help, contact us at 787.706.4111, extension 3112 or 3108.

Popular Risk Services is a subsidiary of Popular, Inc. and an affiliate of Banco Popular and is an Insurance Producer duly authorized by the Office of the Insurance Commissioner to manage life, disability, miscellaneous, title, health and variable insurance business in Puerto Rico. Insurance products are not insured by the FDIC or other government agencies; they are not deposits or obligations of, nor are they guaranteed by, Banco Popular de Puerto Rico or its subsidiaries and/or affiliates. Some insurance products may lose their value.

*Source: Government Development Bank; Statistics Institute of PR

Strategies

Instead of giving up on providing the basic and essential health care, human resources’ professionals are forced to do more with less, which requires technological and operational support for their processes:

Technology:

1. Use the “EXCHANGE” health platform – The most efficient and simple way for employers to provide more benefits to their employees. The employer provides a fixed contribution and various alternatives of companies and products. The employee chooses the product that best meets his or her needs and budget.

2. Transfer the role of SERVICES benefits – Use a specialized service team with an electronic platform and a call center to process all the daily requests and inquiries and claims of employees. This sets free the employer from this costly responsibility and gives employees 24/7 access to health plan management services.

Operations:

3. Transfer the role of ADMINISTRATION benefits – Delegate to an Administrator the job of processing and documenting for COBRA, FMLA, SINOT, , ERISA, HIPAA, SARs, SPD, SMM, Endorsements and 5500’s.

4. Transfer the role of MANAGEMENT benefits – Implement a comprehensive and integrated system in which a Benefits Specialist is responsible for all the steps in the benefits’ management process.

5. Develop and implement a WELL BEING AND PREVENTION program – Help reduce the severity and frequency of claims.

6. Analyze the INSURANCE program – Develop a detailed study of how the plan is used and how the health care market behaves to develop a more cost-effective insurance program.

7. Promote FINANCIAL HEALTH for employees – Offer financial planning advice and education in company facilities to benefit all employees.

Popular Risk Services, has a wide range of services and products to help our clients keep their businesses financially stable and healthy. All of the services mentioned above are part of our employee benefits administration and management offerings. Learn more.

For more information on how Popular Risk Services can help, contact us at 787.706.4111, extension 3112 or 3108.

Popular Risk Services is a subsidiary of Popular, Inc. and an affiliate of Banco Popular and is an Insurance Producer duly authorized by the Office of the Insurance Commissioner to manage life, disability, miscellaneous, title, health and variable insurance business in Puerto Rico. Insurance products are not insured by the FDIC or other government agencies; they are not deposits or obligations of, nor are they guaranteed by, Banco Popular de Puerto Rico or its subsidiaries and/or affiliates. Some insurance products may lose their value.